Legislative changes in the past year have proved to be a challenge for HR departments across the board.

You might not be in love with your existing payroll system, but the recent changes have probably left you feeling like you are stuck with your existing system, along with all of its problems!

Using new Real Time Information (RTI) systems, the HMRC work numbers created are typically your payroll number, so you may be asking:

“Is it a difficult task to switch to SAP Payroll?”

NO – it’s simple! You can easily make the change from your current payroll provider to SAP. You do not need to feel obliged to keep your payroll system solely because of the HMRC number.

With the right plan, you can easily swap out that painful payroll system that just isn’t fitting in with your business anymore – and change for the better with the new functionalities available in SAP.

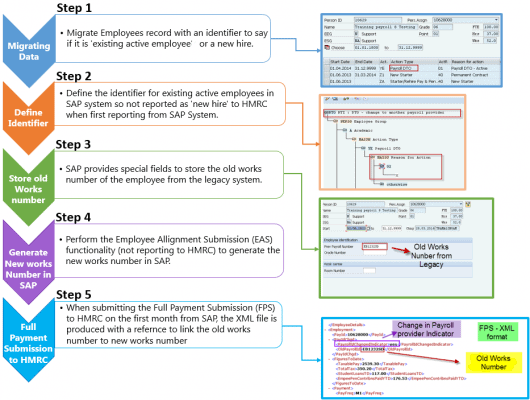

Switch in 5 simple steps

In accordance with SAP guidelines, let us walk you through the process that would be completed after you have your SAP software installed;

View a larger version of this diagram.

In addition to the 5 steps above, Absoft can also help with deciding how much historical information needs to be migrated from your old system.Â

Life simplified

The process of changing your payroll provider to SAP can be done in these quick and easy steps, fully complying with the HMRC rules and regulations.

Absoft just recently completed one of these SAP Payroll implementations in April, with a very satisfied customer.We can provide as much or as little support as you require for any given point in the process.

If you are ready to make the leap then Absoft can provide a soft landing. Our track record in best practice HR implementations and recommendations from our customers speak for us!

For more information, please contact us.